Smart Finance for Nurses: Strategies for Financial Success

Key Highlights

- Learn to manage a nurse’s variable income by creating a flexible budget that adapts to fluctuating paychecks.

- Discover how to build a robust emergency fund to protect yourself from unexpected expenses and provide peace of mind.

- Explore various student loan forgiveness programs, including the Public Service Loan Forgiveness and Nurse Corps Loan Repayment Program.

- Use our personal finance tips to set clear short-term and long-term goals, from saving for a down payment to planning for retirement.

- Understand the essentials of health care finance and how to maximize your workplace benefits to secure your financial future.

- Find out about special home loan programs and grants available to help nurses achieve their dream of homeownership.

Introduction

Your career as a nurse is a calling, but it comes with unique financial pressures. Juggling irregular hours, student loan debt, and the desire to build a secure future can feel overwhelming. Many healthcare workers struggle to get a handle on their personal finances, especially with an income that can change from month to month. This guide is here to help. We will provide a clear, step-by-step approach to financial planning, empowering you to take control of your money and build the life you deserve.

Understanding the Unique Financial Challenges Nurses Face

As a healthcare professional, you have excellent job security and a rising salary. However, these benefits often come with significant challenges. Many nurses graduate with substantial student loan debt, and the demands of the job leave little time for complex financial decisions.

The stress of shift work and unpredictable schedules can make it difficult to focus on long-term planning. Understanding these specific hurdles is the first step toward overcoming them. Let’s look at how to manage a fluctuating income, balance different pay structures, and handle educational costs.

Managing Fluctuating and Variable Income in Nursing

Unlike a salaried employee with a steady income, many nurses, especially a travel nurse or per diem worker, deal with a variable income. Your paycheck can change significantly based on the number of shifts you work, overtime hours, and other factors. This fluctuation makes traditional, rigid budgeting nearly impossible and can be a major source of stress in your personal finances. How can you plan for the future when you don’t know exactly what you’ll earn next month?

The key is to create a budget based on your baseline, most reliable income, not your highest-earning months. This approach prevents you from overspending when you have a great month and ensures your essential expenses are always covered.

One of the most important personal finance tips for nurses is to build a system that anticipates this variability. By tracking your income over several months, you can find an average and plan accordingly, treating any extra income as a bonus for savings or debt repayment.

Balancing Overtime, Per Diem, and Shift Differentials

It’s easy to fall into the mindset of, “I’ll just pick up an extra shift to pay for that.” While overtime, per diem work, and shift differentials are great ways to boost your income, relying on them to cover your regular expenses is a risky financial strategy. These opportunities aren’t always guaranteed and depending on them can create an unstable financial foundation for you and even for experienced nurse practitioners.

This mentality can lead to problems if extra shifts dry up or if you need to take time off. Instead of using this extra money for daily living, effective financial planning means you should earmark it for specific goals. Use it to aggressively pay down debt, build your emergency fund, or boost your retirement savings.

Think of this additional income as a powerful tool for accelerating your financial goals, not as a necessary part of your regular budget. This shift in perspective is crucial for long-term financial stability and peace of mind.

Financial Impacts of Continuing Education Requirements

Your commitment to professional development is one of your greatest assets, but it also comes with a price tag. Continuing education, certifications, and degree completion options are often necessary for career advancement, but they require a significant investment of both time and money. These costs can add another layer of financial pressure, especially when you’re already managing student debt and other responsibilities.

Are you prepared for these expenses? Planning for them is a vital part of your financial journey. Instead of letting these costs sneak up on you, incorporate them into your budget. Set up a dedicated savings account specifically for your professional growth.

Resources are available to help you improve your personal financial literacy and manage these costs. By researching scholarships, grants, and employer tuition reimbursement programs, you can reduce the financial burden of staying current in your field. This proactive approach ensures your career growth doesn’t derail your financial stability.

Building a Reliable Budget on a Nurse’s Variable Income

Now that we’ve identified the challenges, let’s focus on the solution. Creating a budget is the cornerstone of sound financial planning, but it’s especially critical when you have a variable income. A well-crafted budget gives you a clear picture of where your money is going and empowers you to direct it toward your most important goals.

Forget rigid, unforgiving spreadsheets. Your budget needs to be a flexible tool that adapts to your life. The following steps will guide you through tracking your spending, creating an adaptable plan, and using tools to make it all easier.

Practical Steps to Track and Categorize Your Expenses

You can’t manage what you don’t measure. The first step to building a budget is to understand exactly where your money is going. This might feel daunting, but it’s an eye-opening exercise that reveals your spending habits. Start by reviewing your bank and credit card statements from the last two to three months.

Use budgeting apps or a simple spreadsheet to categorize every single expense. This process helps you see patterns you might not have noticed before. Be thorough and honest with yourself during this tracking phase.

Group your expenses into clear categories to see the full picture. Common categories include:

- Housing (rent/mortgage)

- Utilities (electricity, water, internet)

- Transportation (gas, car payments, public transit)

- Groceries and dining out

- Debt payments (student loans, credit cards)

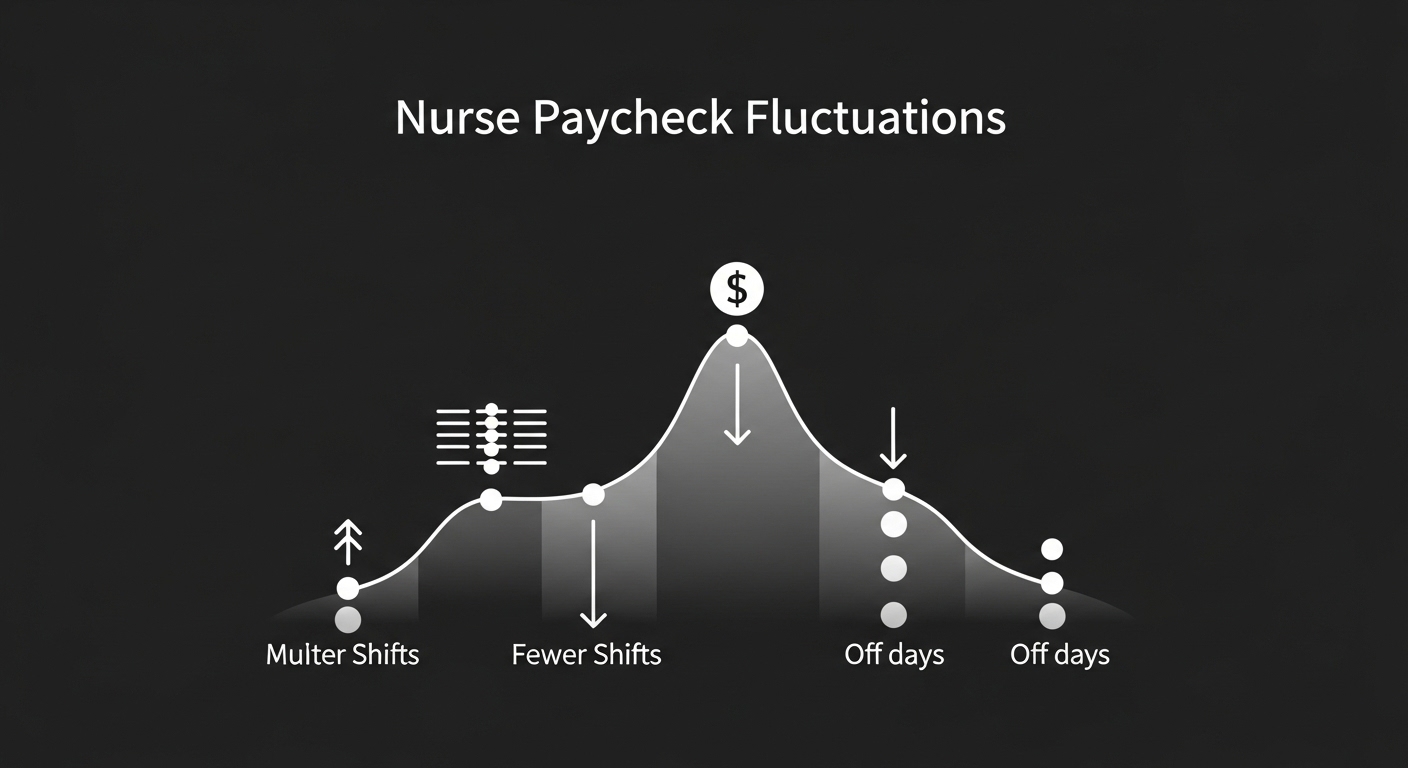

Creating Flexible Budgets that Adapt to Income Changes

For nurses with a variable income, a flexible budget is the best method. One popular and effective approach is the 50/30/20 rule. This framework provides structure while allowing for monthly fluctuations. It helps you prioritize your spending without feeling overly restricted, even when unexpected expenses arise.

The idea is to allocate your after-tax income into three main buckets. This method ensures your needs are met, you have room for fun, and you’re consistently working toward your financial goals. A flexible budget gives you control, reducing the stress of not knowing if you’ll have enough to cover everything.

Here’s how the 50/30/20 budget breaks down:

- 50% for Needs: This includes essentials like housing, utilities, groceries, and minimum monthly payment on debts.

- 30% for Wants: This covers non-essentials like travel, entertainment, and shopping.

- 20% for Savings & Debt: This portion goes toward building savings, investing, and paying down debt beyond the minimum payments.

Recommended Budgeting Tools and Apps for Nurses

You don’t have to manage your budget alone. There are numerous budgeting tools and apps designed to simplify the process and provide valuable personal finance tips. These resources can automate expense tracking, help you visualize your spending, and keep you on track with your goals. Improving your personal financial literacy can be as simple as downloading an app.

Many of these tools connect directly to your bank accounts and credit cards, automatically categorizing transactions for you. This saves you time and reduces the chance of manual error. Some apps also offer features like bill reminders and credit score monitoring.

When choosing a budgeting tool, look for these features:

- Automatic expense tracking and categorization

- Customizable budget categories

- Goal-setting and progress tracking

- Bill payment reminders

- Tools to monitor your savings and credit score

Setting Clear Financial Goals for Every Stage of Your Nursing Career

A budget tells you where your money is going, but financial goals give your money a purpose. Setting clear, achievable goals is essential for managing your personal finances and building long-term wealth. Without specific targets, it’s easy to drift without making meaningful progress.

Your goals will evolve throughout your career, from building an emergency fund in your early years to planning for retirement later on. Let’s break down how to set effective short-term and long-term goals that align with your professional journey.

Short-Term Goals: Emergency Funds and Daily Savings

Your first financial priority should be creating a safety net. An emergency fund is money set aside specifically for life’s unexpected events, like a car repair, a medical bill, or a sudden loss of income. For nurses, having this cushion is especially important due to the high-stress nature of the job. Financial experts recommend saving three to six months’ worth of essential living expenses.

While that number might seem intimidating, start small. The most important step is to begin. Open a separate, high-yield savings account for your emergency fund to keep it separate from your regular checking account. This makes it less tempting to dip into for non-emergencies.

Effective financial planning involves making saving automatic. Set up a recurring transfer from your checking to your savings account each payday, even if it’s just $25. This “pay yourself first” strategy ensures you’re consistently building your fund without having to think about it.

Long-Term Goals: Retirement Planning and Investments

Retirement might feel like it’s a lifetime away, but the sooner you start planning, the more time your money has to grow. As a nurse, you have several retirement planning options available. If you work for a private hospital, you likely have access to a 401(k). Public or non-profit organizations often offer a 403(b), while government positions may come with a Thrift Savings Plan (TSP) or pension.

Many employers offer a matching contribution, which is essentially free money. Aim to contribute at least enough to get the full employer match. Beyond workplace plans, you can open an Individual Retirement Account (IRA). A Traditional IRA may offer a tax deduction now, while a Roth IRA provides tax-free withdrawals in retirement.

It’s never too early or too late to focus on your retirement savings. Even small, consistent contributions can grow into a substantial nest egg over time, giving you the freedom to retire comfortably when you choose.

Aligning Financial Goals with Professional Growth

Your financial goals should work in harmony with your career ambitions. As you advance in your nursing career, your personal finances will need to adapt. Whether you’re pursuing an advanced degree or a specialized certification, this professional development requires financial planning. How will you pay for tuition and manage a potential reduction in work hours while you study?

This is where SMART goals become invaluable. This framework turns vague aspirations into actionable plans. By defining your goals clearly, you create a roadmap for both your career and your finances.

A SMART goal is:

- Specific: Clearly define what you want to achieve.

- Measurable: Set a target amount or metric to track progress.

- Attainable: Ensure the goal is realistic for your situation.

- Relevant: Align the goal with your broader life and career plans.

- Time-Based: Set a deadline to create urgency.

Smart Savings Strategies for Nurses

Building savings is your pathway to financial freedom. It provides security, reduces stress, and gives you the resources to pursue your dreams. For nurses, smart savings strategies are about more than just building an emergency fund; they’re about creating habits that improve your overall financial literacy.

Putting money away consistently can feel challenging with an inconsistent income, but it’s entirely possible with the right approach. Let’s explore some practical strategies for building your emergency savings, automating the process, and making the most of your employer’s benefits.

Emergency Fund Essentials for Healthcare Employees

As a healthcare worker, you face a high-risk, high-stress environment every day. An emergency fund is not a luxury—it’s an absolute necessity for your peace of mind. This fund acts as a financial buffer, protecting you from taking on high-interest debt when unexpected expenses arise. Whether it’s a sudden illness or a necessary home repair, having this cash reserve means a financial hiccup won’t turn into a crisis.

Aim to save at least three to six months’ worth of essential living expenses. Start by calculating your bare-bones monthly budget—what you need to cover housing, food, and utilities. This is your initial target.

To build your fund effectively, follow these steps:

- Open a separate high-yield savings account.

- Set a clear savings goal (e.g., $10,000).

- Automate weekly or bi-weekly transfers.

- Direct any windfalls, like a bonus or tax refund, directly into this account.

- Once you hit your goal, only touch it for true emergencies.

Tips for Automating Your Savings on Inconsistent Paychecks

One of the most effective personal finance tips for nurses with little time is automation. Automating your savings removes the need for willpower and ensures you’re consistently putting money aside, regardless of how busy or tired you are. This “set it and forget it” approach is perfect for managing an inconsistent income.

The simplest way to start is by setting up an automatic transfer from your checking account to your savings account. Schedule it for every payday. Even a small, regular amount adds up significantly over time. You can also split your direct deposit.

Here are a few ways to automate:

- Split Your Direct Deposit: Ask your HR department to send a fixed amount or percentage of each paycheck directly to your savings account.

- Schedule Automatic Transfers: Set up recurring transfers through your bank’s online portal.

- Use Savings Apps: Some apps analyze your spending and automatically move small, affordable amounts into savings for you.

Ways to Maximize Workplace Benefits and Employer Programs

Your salary is only one part of your total compensation. Workplace benefits and employer programs offer tremendous value and can significantly accelerate your wealth-building journey. Are you taking full advantage of everything your employer offers? Failing to do so is like leaving free money on the table.

Start by thoroughly reviewing your benefits package. The most valuable benefit is often the retirement plan match. If your employer offers to match your 401(k) or 403(b) contributions up to a certain percentage, contribute at least enough to get the full match. This is an immediate, guaranteed return on your investment.

Look for these other valuable employer programs:

- Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs)

- Tuition reimbursement for continuing education

- Health insurance and wellness programs

- Life and disability insurance options

- Employee stock purchase plans

Navigating Student Loans and Nurse Loan Forgiveness Programs

Nursing school is a major investment, and for many, it comes with significant student loan debt. This financial burden can feel overwhelming, but you have options. Numerous student loan forgiveness programs are available specifically for nurses, designed to help you reduce or eliminate your debt in exchange for service.

Navigating these programs can be confusing, but the potential savings are well worth the effort. From the popular Public Service Loan Forgiveness to the Nurse Corps Loan Repayment Program, let’s explore the pathways to freeing yourself from student loans.

Federal Programs: Public Service Loan Forgiveness and Nurse Corps LRP

The federal government offers several powerful loan forgiveness programs for nurses. The Public Service Loan Forgiveness (PSLF) program is one of the most well-known. It forgives the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments while working full-time for a qualifying employer, such as a non-profit hospital or government agency.

Another key program is the Nurse Corps Loan Repayment Program (LRP), administered by the Health Resources and Services Administration (HRSA). This program repays up to 85% of your nursing education debt in exchange for working at a Critical Shortage Facility. Other options include the National Health Service Corps (NHSC) LRP for those working in underserved areas. These programs provide substantial relief for eligible healthcare professionals.

| Program Name | Key Benefit | Service Requirement |

|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Full loan forgiveness | 120 qualifying payments while working for a non-profit or government employer. |

| Nurse Corps Loan Repayment Program | Repays up to 85% of loans | 2-3 years of service at a Critical Shortage Facility. |

| National Health Service Corps (NHSC) LRP | Up to $75,000 in loan repayment | 2-year commitment at an NHSC-approved site in an underserved area. |

| Faculty Loan Repayment Program (FLRP) | Up to $40,000 toward loans | 2-year contract as a faculty member at an accredited nursing school. |

State-Based and Hospital Loan Repayment Options

Beyond federal programs, don’t overlook opportunities closer to home. Many states offer their own loan forgiveness programs to incentivize nurses to work in high-need areas within the state. These state-based options can be just as valuable as their federal counterparts. For example, the Massachusetts Loan Repayment Program and the Minnesota Health Care Loan Forgiveness Program provide significant funds to healthcare providers serving underserved communities.

Additionally, some hospitals and healthcare systems offer their own loan repayment assistance as a recruitment and retention tool. These hospital repayment programs are often part of a comprehensive benefits package designed to attract top talent.

When you’re job hunting or negotiating a contract, always ask if the employer offers any form of student loan assistance.

Exploring these local and institutional options can open up new avenues for loan forgiveness that you might not have been aware of. Be sure to check your state’s department of health website and inquire with HR departments at potential employers.

Step-by-Step Guide to Applying for Loan Forgiveness as a Nurse

Applying for loan forgiveness requires careful attention to detail, but a systematic approach can make the process manageable. The application process varies by program, but most follow a similar path. The first step is always to thoroughly research the programs you might qualify for and understand their specific eligibility requirements.

Once you identify a promising program, you’ll need to gather extensive documentation. This often includes proof of employment, loan statements, and professional licenses. Submitting an incomplete or inaccurate application is a common reason for denial, so take your time and double-check everything before you submit.

Follow this general guide to navigate the application process:

- Research: Identify programs for which you meet the basic eligibility requirements.

- Verify Your Employer: For programs like PSLF, confirm your employer qualifies.

- Gather Documents: Collect pay stubs, W-2s, loan details, and your nursing license.

- Complete the Application: Fill out all forms accurately and completely.

- Submit: Send your application by the deadline, and keep copies of everything.

- Follow Up: Confirm your application was received and monitor its status.

- Certify Annually: For long-term programs like PSLF, certify your employment each year.

Grants and Scholarships for Working Nurses

Paying for advanced education doesn’t have to mean taking on more debt. A wealth of financial aid is available in the form of grants and scholarships specifically for working nurses. Unlike loans, this is money you don’t have to pay back.

These funds can help you pursue an advanced degree, complete your BSN, or gain specialized skills. For aspiring nurse leaders, securing these awards is a smart way to invest in your future without the financial strain. Let’s look at where to find these valuable opportunities.

Scholarships for Advanced Education and RN-to-BSN Programs

Whether you are pursuing an RN-to-BSN program or a master’s degree, scholarships can provide crucial financial assistance. Many professional organizations, foundations, and universities offer awards to support nurses in their advanced education journey. These scholarships recognize your dedication to the profession and help offset the high cost of tuition, books, and fees.

Some scholarships are merit-based, while others are geared toward nurses from specific backgrounds or those entering certain specialties. For instance, the Edna Lauterbach Scholarship supports New York nurses specializing in home and community-based care. Doing thorough research is key to finding the awards that match your profile.

Here are some places to look for scholarships:

- Professional nursing associations (e.g., American Nurses Association)

- Your employer or healthcare system

- The financial aid office at your chosen college of nursing

- Foundations dedicated to nursing education

- State-specific nursing foundations

- Online scholarship search engines

Grants Tailored for Nurses in Specialized Fields

Grants are another excellent source of funding, often targeted toward nurses working in or training for specialized fields. Many government and private grants aim to address staffing shortages in critical areas. If you work in a designated critical shortage facility or an underserved community, you may be eligible for specific grant funding. These opportunities can be particularly beneficial for nurse practitioners and other advanced practice nurses.

For example, the Health Well Foundation’s Frontline Healthcare Workers Behavioral Health Fund provides grants to help cover the cost of mental health services for nurses. Other grants might focus on supporting nurses in gerontology, oncology, or pediatrics.

Look for grants from these sources:

- Federal agencies like HRSA

- State departments of health

- Private foundations focused on healthcare

- Non-profit organizations supporting specific patient populations

- Professional organizations for specialized nursing fields

Application Tips to Secure Financial Aid Packages

A strong application can make all the difference in securing financial aid. The application process is often competitive, so it’s essential to present yourself in the best possible light. Start by reading the eligibility requirements and application instructions carefully. Missing a single detail could disqualify you.

Your personal essay or statement of purpose is your chance to shine. Use it to tell your story, explain your career goals, and convey your passion for nursing. Tailor each application to the specific grant or scholarship, highlighting how your goals align with the organization’s mission.

Follow these tips to improve your chances:

- Start Early: Give yourself plenty of time to gather documents and write a thoughtful essay.

- Proofread Everything: Typos and grammatical errors look unprofessional. Ask someone to review your application before you submit it.

- Highlight Your Achievements: Showcase your academic, professional, and volunteer accomplishments.

- Follow Instructions: Adhere to all guidelines, including word counts and deadlines.

Home Loan and Mortgage Programs Designed for Nurses

Owning a home is a cornerstone of the American dream, and as a nurse, you have access to special programs that can make this goal more attainable. Lenders recognize the stability and importance of the nursing profession and have created home loan and mortgage products to help you.

Programs like the Nurse Next Door can offer grants and down payment assistance, making the upfront cost of buying a home more manageable. Talk to a loan officer who is familiar with these programs to explore all your options.

Exploring Nurse-Specific Home Loan Products and Eligibility

Owning a home is a cornerstone of the American dream, and as a nurse, you have access to special programs that can make this goal more attainable. Lenders recognize the stability and importance of the nursing profession and have created home loan and mortgage products to help you.Programs like the Nurse Next Door can offer grants and down payment assistance, making the upfront cost of buying a home more manageable. Talk to a loan officer who is familiar with these programs to explore all your options.Exploring Nurse-Specific Home Loan Products and EligibilitySeveral home loan programs are designed to assist healthcare professionals. While not “mortgages” in the traditional sense, programs like Nurse Next Door and Homes for Heroes act as assistance programs that connect you with lenders and may offer financial benefits.

Exploring Nurse-Specific Home Loan Products and Eligibility

Several home loan programs are designed to assist healthcare professionals. While not “mortgages” in the traditional sense, programs like Nurse Next Door and Homes for Heroes act as assistance programs that connect you with lenders and may offer financial benefits. These programs understand the unique financial profiles of nurses and can help streamline the home-buying process.

The eligibility requirements for each type of loan vary, but they generally require you to be a currently employed nurse purchasing a primary residence. The benefits can include access to grants, down payment assistance, and potentially more competitive interest rates or reduced closing costs. While a conventional loan might still be your best option, it’s wise to explore these nurse-specific products first.

Key features of these programs may include:

- Grants for down payment or closing costs

- Down payment assistance of up to $15,000

- Reduced fees, such as for appraisals or applications

- Connections to a network of approved real estate agents and lenders

Grants and Down Payment Assistance Opportunities for Nurses

The biggest hurdle to homeownership for many is saving up for the down payment and closing costs. Fortunately, there are grants and down payment assistance programs available to help nurses overcome this obstacle. These programs can provide thousands of dollars in financial aid, significantly reducing the amount of cash you need to bring to the closing table.

The Nurse Next Door program, for example, offers grants of up to $8,000 and down payment assistance that can reach $15,000. Another resource is the Everyday Hero Housing Assistance Fund, which helps community heroes, including nurses, with their home purchase. These funds can make a huge difference in your ability to buy a home sooner.

Explore these opportunities for assistance:

- Nurse Next Door Program: Offers grants and down payment assistance.

- Homes for Heroes: Provides savings through a network of real estate professionals.

- Everyday Hero Housing Assistance Fund: Helps with down payments and closing costs.

- State and Local Programs: Check your state’s HUD website for first-time home buyer programs that you may qualify for.

Conclusion

In conclusion, navigating finances as a nurse with a variable income can be challenging, but it is absolutely manageable with the right strategies. By understanding your unique financial situation and implementing flexible budgeting techniques, you can create a reliable financial plan that adapts to your ever-changing income. Remember to set clear financial goals that align with your career aspirations, and explore available resources like grants, scholarships, and specialized loan programs. With the right tools and knowledge, you’ll not only reduce financial stress but also pave the way toward long-term wealth building. For further insights and detailed guidance, don’t hesitate to check out our blog.

Frequently Asked Questions

01. What budgeting method works best for nurses with variable income?

The best budgeting method for nurses with a variable income is a flexible one, like the 50/30/20 rule. This approach, combined with diligent expense tracking using budgeting apps, allows your personal finances to adapt to monthly pay fluctuations. Base your budget on your minimum guaranteed income and use extra earnings for savings goals.

02. How can nurses reduce stress around finances and still build wealth?

Nurses can reduce financial stress by automating savings, building a robust emergency fund for unexpected events, and strategically paying down high-interest credit card debt. Improving your financial literacy through consistent financial planning provides a clear roadmap to building wealth, giving you confidence and control over your personal finances.

03. Are there special investment options or retirement plans for nurses?

While there aren’t nurse-exclusive investment products, healthcare professionals have access to excellent retirement plans. These include employer-sponsored 401(k)s or 403(b)s, often with matching contributions. Additionally, all nurses can use a Traditional IRA or Roth IRA to supplement their retirement savings and build long-term wealth.